how to declare mileage on taxes

What are the standard mileage tax deduction rates for prior years. Every feature included for everyone.

How To Claim Mileage From The Irs Step By Step Updated Guide For

The IRS has no maximum amount of mileage you can claim as long as you can substantiate them.

. How To Declare Your Vehicle A Business Vehicle For Taxes Carvana Blog Mileage Tax Deduction Claim The Mileage Tax Deduction Or Take The Standard Deduction Taxact Blog. Your beginning vehicle mileage. How To Claim Mileage on Your Taxes.

How to Deduct Mileage from your Taxes. 17 cents per mile for medical miles moving miles. Anything below the approved amount You will not have to report to HMRC or pay tax.

Keep track of the miles that youve driven for business-related excursions. Here are the five steps youll need to take to claim mileage on your taxes. To determine how much you could claim work out how much of the mileage allowance would be used for fuel.

However there are a few red flags that will put you in trouble with the IRS. Once you figure out how many miles you traveled for. Choose your method of calculation.

The best way to Create a Mileage Expense Sheet in Excel Begin Excel and choose the File tab. To use this method you. The mileage tax deduction is calculated by multiplying qualified mileage by the annual rate set by the Internal Revenue Service.

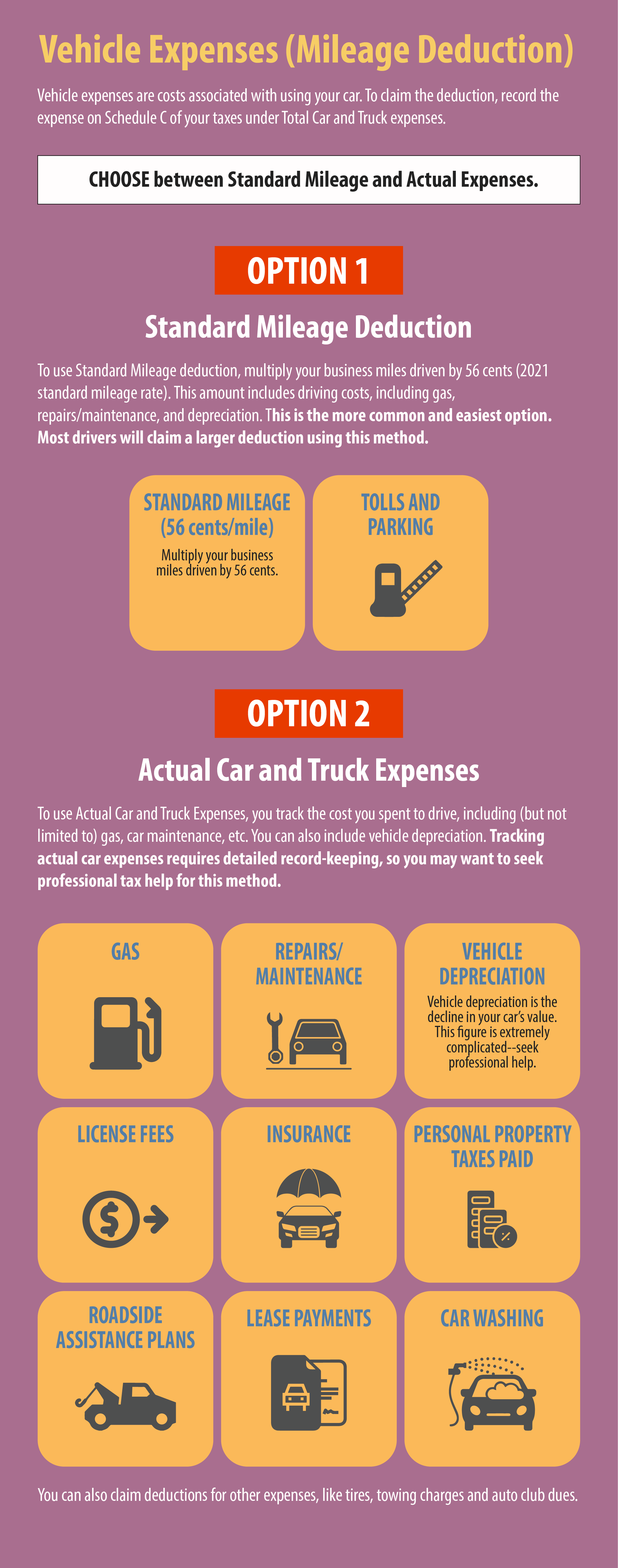

You will need to choose either the actual expense method or the. Add up the mileage for each vehicle type youve used for work take away any amount your employer pays you towards your costs sometimes called a mileage allowance Approved. The mileage tax deduction rules generally allow you to claim 056 per mile in 2021 if you are self-employed.

If you are an employee you cannot deduct gas mileage as an unreimbursed expense on your tax return. Deduct your mileage expense to lower your taxable income. The actual car expense method lets you claim a car repair insurance and other.

Add anything above the approved amount to the employees pay and deduct and pay tax as normal. The standard IRS mileage rate for the 2021 tax. As of June 2018 a 1401cc to 2000cc petrol car would have.

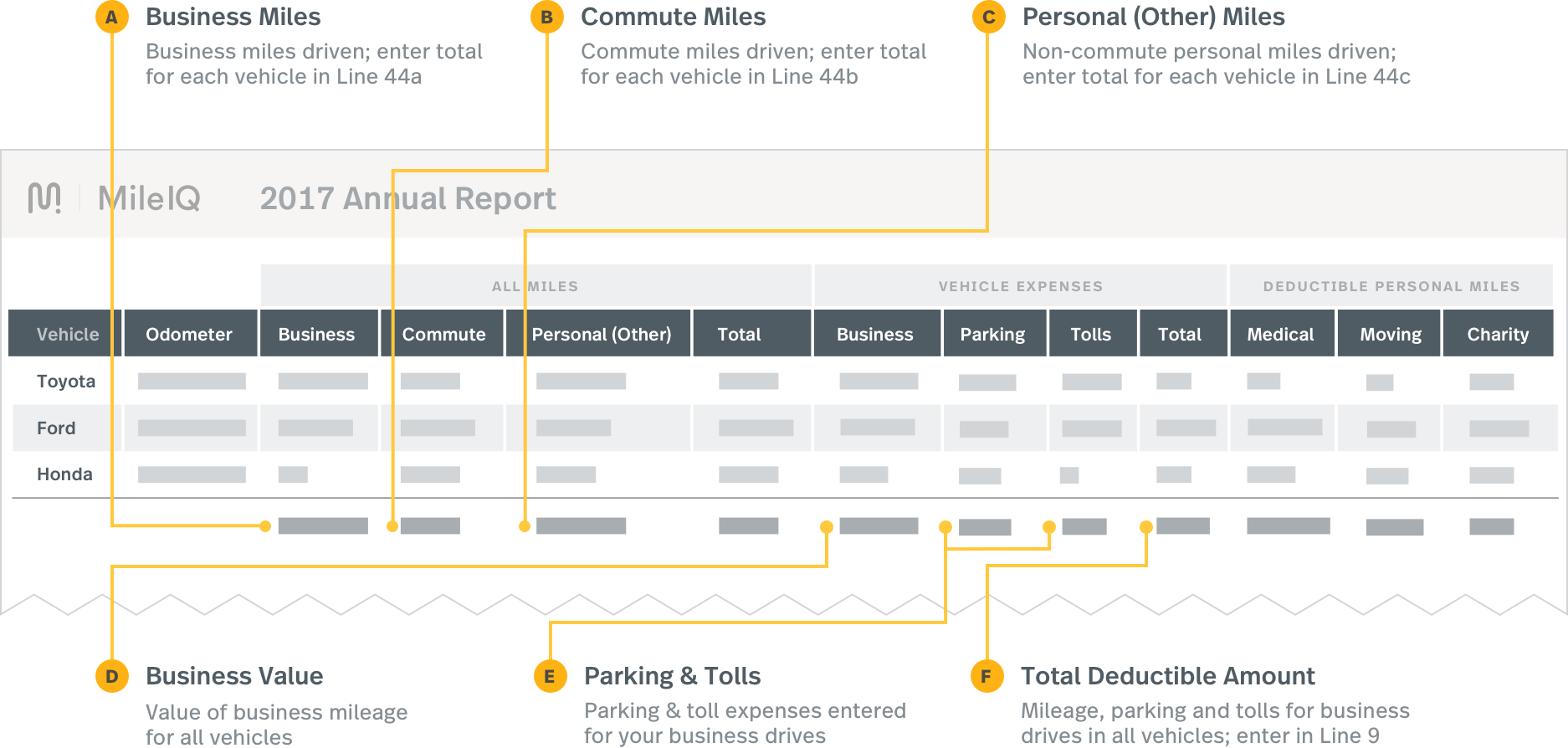

You may also be able to claim a tax deduction for mileage in a few. If youre claiming a deduction for business mileage youll report it using Schedule C on Form 1040. The maximum that can be paid tax-free is calculated as the number of business miles for which a passenger is carried multiplied by a rate expressed in pence per mile.

In general there are two ways of claiming a tax benefit claiming mileage and actual car expenses. 2 To claim mileage deductions for. Once you are in your tax return click on the Business tab.

Mileage Vs Actual Expenses Which Method Is Best For Me

How To Claim The Standard Mileage Deduction Get It Back

Irs Mileage Reimbursement 2022 Everything You Need To Know About

Reporting Mileiq Mileage With Tax Software Mileiq

Your Complete Guide To Claiming Mileage Tax Deduction In 2019

Self Employed Mileage Deduction Guide Triplog

Figuring Your Tax Deduction After The Irs Boosts Mileage Rates Bloomberg Law

Free Mileage Log Templates Smartsheet

The Ultimate Guide To Tax Deductions For The Self Employed Article

Is Mileage Tax Deductible What You Need To Know About Claiming Mileage

How To Claim Mileage And Business Car Expenses On Taxes

Irs Boosts Mileage Rate Deductions As Gas Prices Soar To 5 A Gallon

How To Record Mileage Help Center

How To Make The Most Of Business Mileage Deductions Due

California Employers Association 2022 Irs Mileage Rate Is Up From 2021

Can You Deduct Business Mileage On Your Taxes

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition